... using the double declining balance depreciation method.

- $28200, $27200, $17350

- $27500, $25000, $16210

- $26000, $25200, $16100

- $27000, $25200, $15120

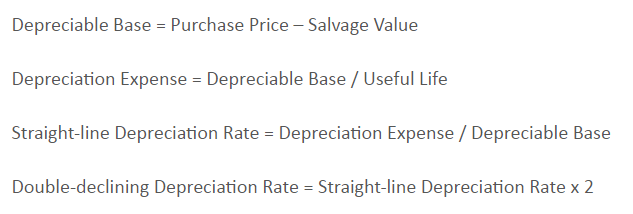

The double declining balance depreciation method is one of two common methods a business uses to account for the expense of a long-lived asset. The double declining balance depreciation method is an accelerated depreciation method that counts twice as much of the asset’s book value each year as an expense compared to straight-line depreciation. The formula is:

Depreciation for a period = 2 x straight-line depreciation percent x book value at beginning of period.

investopedia.com/terms/d/double-declining-balance-depreciation-method.asp

hstrategiccfo.com/double-declining-depreciation-formula

90000 - 20000 = 70000

70000 / 5 = 14000

14000 / 70000 = 0.2

0.2 * 2 = 0.4

90000 * 0.4 = 36000

36000 * 0.75 = 27000 (первый год)