- Straight line method

- Declining balance method

- Activity depreciation method

- Units of production depreciation method

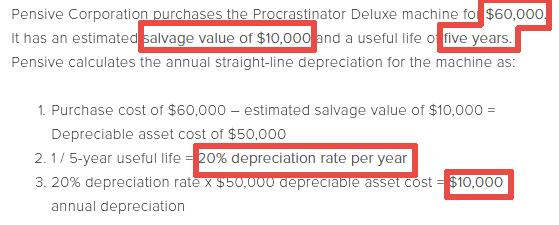

Straight line depreciation

Straight line depreciation is the default method used to gradually reduce the carrying amount of a fixed asset over its useful life. The method is designed to reflect the consumption pattern of the underlying asset, and is used when there is no particular pattern to the manner in which the asset is to be used over time. Use of the straight-line method is highly recommended, since it is the easiest depreciation method to calculate, and so results in few calculation errors.

Declining depreciation

A declining balance method is a common depreciation-calculation system that involves applying the depreciation rate against the non-depreciated balance. Instead of spreading the cost of the asset evenly over its life, this system expenses the asset at a constant rate, which results in declining depreciation charges each successive period. For example, if an asset that costs $1,000 is depreciated at 25% each year, the deduction is $250 in the first year, $187 in the second year, and so on.

Activity depreciation

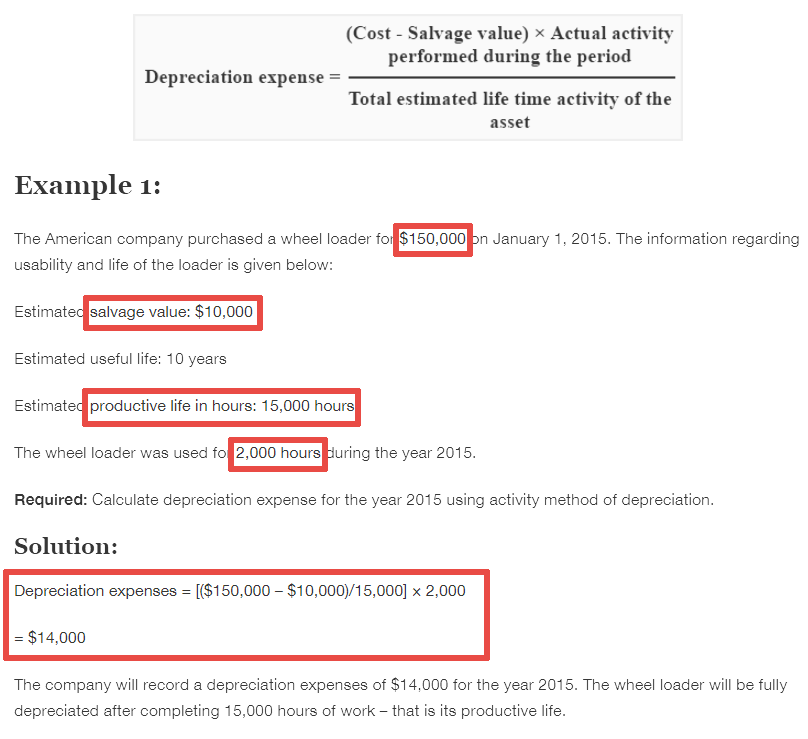

Under activity method, the depreciation expense is calculated on the basis of asset’s activity such as the number of units produced or the number of hours the asset is used during the period. In other words, this method focuses on the actual use of the asset rather than the passage of time.

Units of production depreciation

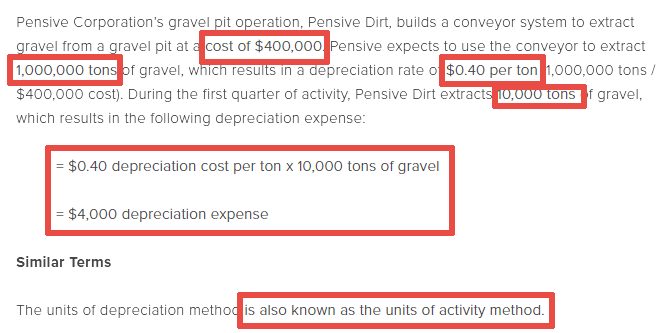

Under the units of production method, the amount of depreciation charged to expense varies in direct proportion to the amount of asset usage.

Thus, a business may charge more depreciation in periods when there is more asset usage, and less depreciation in periods when there is less usage.

It is the most accurate method for charging depreciation, since this method links closely to the wear and tear on assets.

However, it also requires that someone track asset usage, which means that its use is generally limited to more expensive assets.

Also, you need to be able to estimate total usage over the life of the asset in order to derive the amount of depreciation to recognize in each accounting period.